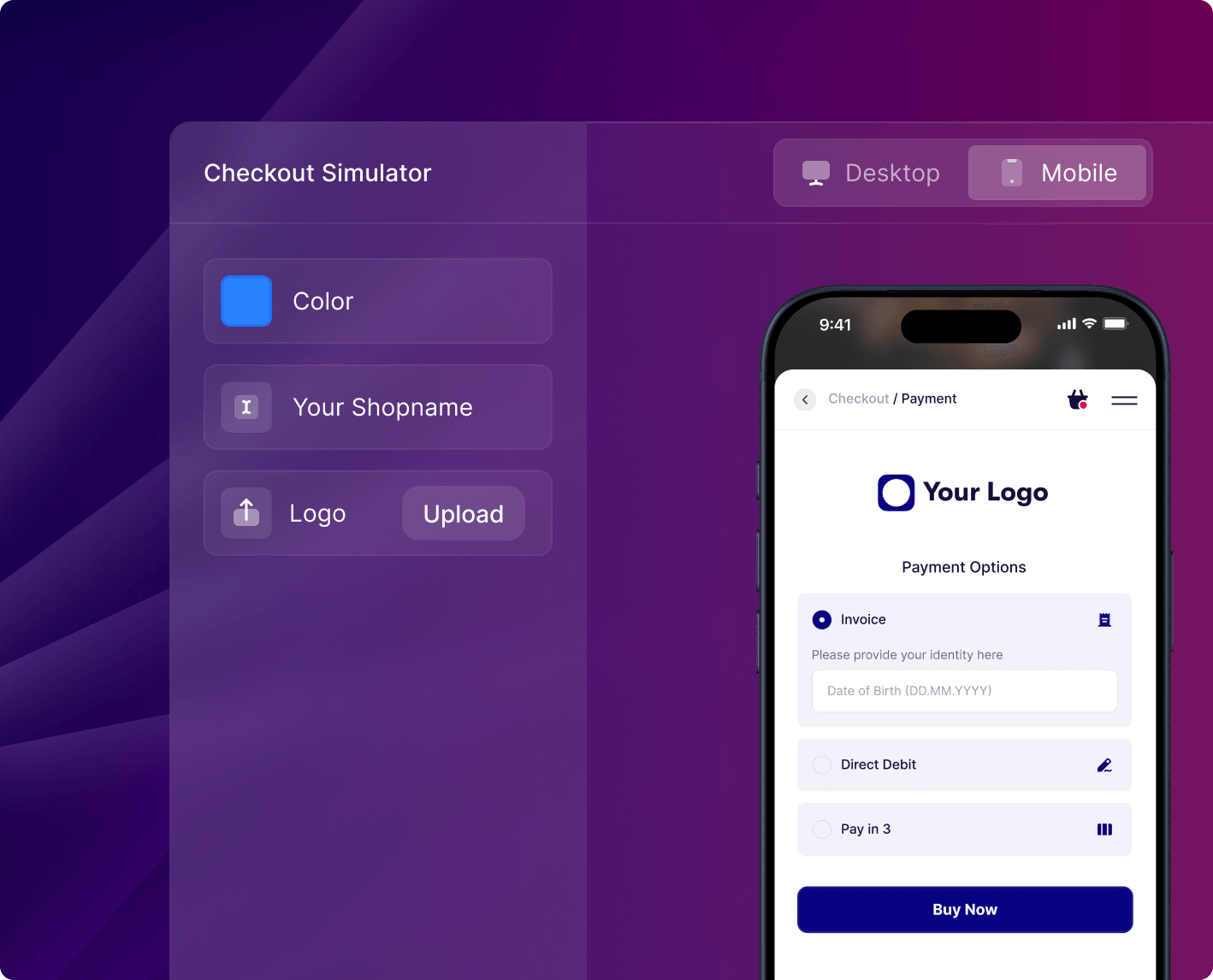

Checkout Simulator

Customizable payments that let your merchants’ brand shine

Our solutions are fully customizable and seamlessly integrated into your merchants’ checkout, keeping customers fully within their brand experience – not ours.

Brand integrity instead of brand dilution

Branded checkout, confirmations, and buyer portal

Friendly communication and customer service in their tone