Payment solutionsNovember 17, 2025

The best 7 Buy Now, Pay Later providers in Germany

Which BNPL providers are active on the German market?

Clara Porath

Content & Communications Manager

Buy now, pay later, or BNPL for short, has enjoyed unparalleled success in e-commerce since 2016 – both globally and in Germany. BNPL payments are expected to grow at a staggering rate of 23.8 percent between 2021 and 2028. And the BNPL gross merchandise value in Germany is forecast to jump from $12 billion in 2020 to $83 billion in 2028.

This success is no coincidence. After all, the payment option combines convenience, security, and flexibility, making it a favorite among many consumers. Especially in times of inflation, when financial flexibility matters more than ever, BNPL offers shoppers exactly what they need: the ability to manage their budgets without compromising on choice.

To stay competitive in German e-commerce, online shops should therefore offer at least one Buy Now, Pay Later option at checkout. However, implementing BNPL in-house comes with significant financial risks.

The smarter approach? Partner with an experienced payment provider who can handle the complexity and mitigate risk—while you focus on growing your business.

BNPL providers at a glance

In this article, we provide an overview of the most important BNPL providers in Germany. This helps online merchants who haven’t yet integrated BNPL get a first look at potential partners. And for those considering a switch, we introduce attractive alternatives.

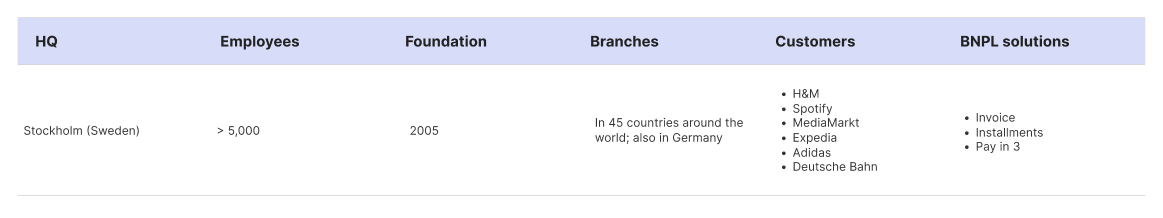

Klarna

Klarna is considered one of the world’s leading payment providers. Founded in 2005 in Stockholm, Sweden, the company operates its German headquarters in Munich. In 2017, Klarna obtained a full banking license from the Swedish Financial Supervisory Authority, valid across the entire European Economic Area. And in fall 2025, the company successfully went public with its IPO on the New York Stock Exchange.

Facts and Figures

Sources:

https://de.statista.com/statistik/daten/studie/818207/umfrage/umsatz-von-klarna-weltweit/

https://www.klarna.com/de/uber-uns/

Klarna's BNPL solutions

Klarna offers three BNPL solutions: payment by invoice, installments, and Pay in 3.

Invoice: Klarna typically offers a 30-day payment term. Shoppers don’t need a Klarna account to use this BNPL option. Instead, the invoice can be paid easily via online banking. However, anyone wishing to extend the payment period up to 60 days or convert the amount into an installment plan can only do so against a fee via the Klarna app.

Klarna installment plan: The installment plan allows shoppers to split payments into 6, 12, 24, or 36 monthly rates. Even before adding an item to the cart, shoppers can see which products qualify for Klarna installments and what the monthly payments would be. A binding credit check, however, only takes place during checkout.

Pay in 3: This option enables shoppers to divide the total amount into three interest-free and equal payments. The first payment is due on the day of purchase, the second after 30 days, and the third after 60. Shoppers can pay via credit or debit card or using SEPA direct debit.

What makes Klarna different?

In addition to traditional BNPL products, Klarna offers a wide range of other financial products and services. These include the Klarna bank account, Klarna Pools, fixed-term deposit accounts, and real-time transfers.

On top of that, there's the Klarna Creator platform, which is meant to bring influencers and retailers closer together. In 2021, Klarna revamped its app, creating “a mix of shopping and banking app – based on Asian super apps.” Two years later, Klarna introduced a price comparison tool, and in 2025, it launched its own credit card.

All these examples show: Klarna combines online shopping, payment options, account management, price comparison and monitoring, shipment tracking, and return management – including automatic coupon and cashback features.

Anyone who enters the Klarna universe can access a comprehensive range of services related to shopping, payments, and financial management. In our article “Buy now, pay later apps and their diverse functionalities and services,” (in German), you can learn more about the advantages and disadvantages this can have.

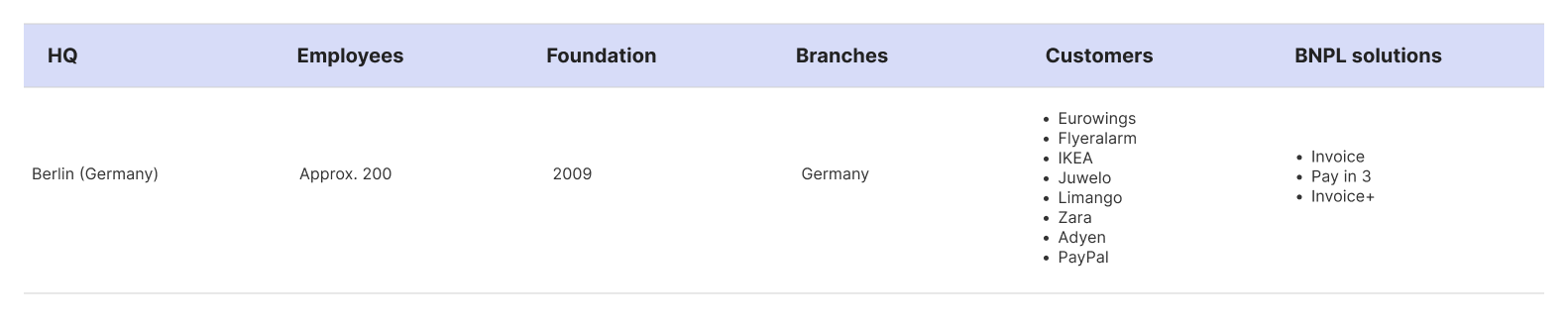

Ratepay

Founded in 2009, the Berlin-based FinTech specializes in white label BNPL payment solutions: the company is Europe’s leading white label BNPL provider in the B2C segment. Since 2019, Ratepay has been part of the Nets Group, which merged with the Italian Nexi Group in 2021.

Facts and Figures

Ratepay’s BNPL solutions

Ratepay offers invoice payments, the possibility to turn invoices into installments later on, and the option for three interest-free installments.

Invoice: Payments are made exclusively via online banking. As a white label provider, Ratepay doesn’t offer an app and never requires customers to create an account during the payment process. They only need to provide a valid email address to receive the invoice.

When it comes to due dates, Ratepay does not impose a fixed payment term. Instead, the payment provider works with merchants to define individual due dates based on their industry and business model. With the “Pay Later” option, this date can be extended by up to 150 days after purchase.

If payment deadlines overlap with return or cancellation periods, the invoice due date is simply suspended. This so-called “dunning block” ensures that shoppers do not fall into arrears without any fault of their own.

Pay in 3: With Pay in 3, shoppers can split the total purchase amount into three interest-free installment rates. The first payment is due 30 days after shipping, the second after 60 days, and the third after 90 days. And merchants benefit twice: not only do they offer shoppers more flexibility, they also receive payout upfront.

What makes Ratepay different?

Ratepay offers its BNPL payment methods as white label solutions. They are fully customizable and seamlessly integrated into the checkout. This means they appear as part of the shop’s own offering. No redirects to third-party apps, e-wallets, or external portals. The entire process happens directly in the shop’s checkout.

What about customer communication after purchase? It’s also handled by Ratepay. Of course, in the shop’s name and corporate language.

In short: Ratepay stays fully invisible and never steps between the shop and its customers to promote its own products or services. Moreover, customer data is used exclusively for payment processing.

The benefits of this approach:

✔ Fewer cart abandonments

✔ More new customers

✔ Stronger customer loyalty

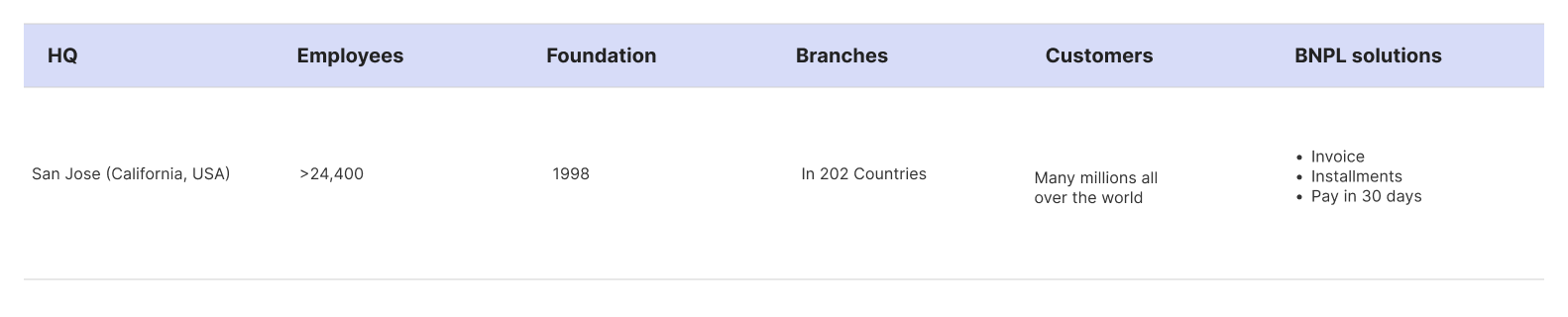

PayPal

The American company was founded in 1998 and has been active on the German market since 2004. Today, PayPal is one of the most popular payment methods for online shopping in Germany.

Facts and Figures

Sources:

https://sqmagazine.co.uk/how-many-people-work-at-paypal/

https://de.statista.com/statistik/daten/studie/300215/umfrage/umsaetze-von-paypal-weltweit-quartalszahlen/

https://www.paypal.com/de/webapps/mpp/country-worldwide

https://de.dreamstime.com/september-san-jose-ca-usa-paypal-hauptsitz-im-silicon-valley-holdings-inc-ist-ein-amerikanisches-unternehmen-das-weltweites-online-image157695545

https://www.paypal.com/de/digital-wallet/ways-to-pay/buy-now-pay-later

https://de.ryte.com/wiki/PayPal

PayPal’s BNPL solutions

PayPal Germany offers three BNPL options: invoice, pay in 30 days, and installments.

Invoice: PayPal typically grants a 14-day payment term – though 30 days are also possible. No PayPal account is required to pay by invoice. Shoppers can simply pay via online banking. By the way: the invoice payment is powered by Ratepay’s technology. The company has been PayPal’s exclusive partner for the „PayPal Checkout“ in Germany since 2022.

Pay in 30 days: With this option, PayPal automatically debits the total amount from the customer’s linked bank account after 30 days. For this, a PayPal account is required, and it is only available for purchases up to €2,000. For an additional one-time fee, shoppers can extend the payment period by up to 54 days.

Installments: Shoppers can split their payments into 3, 6, 12, or 25 monthly installments, and PayPal debits the rates directly from the linked bank account. Early repayment – no matter if partial or full – is possible at any time and without fees. Subject to credit approval, multiple installment plans can run in parallel. PayPal’s installment plans start at €99.

What makes PayPal different?

As one of the most trusted payment providers worldwide, PayPal enjoys strong consumer confidence in Germany. That’s why integrating PayPal into your checkout is generally recommended.

Additional benefits for shoppers include:

✔ No transaction fees for online purchases

✔ Free money transfers to friends or other individuals within Germany

✔ Free transfers from PayPal to a bank account

There’s more: PayPal’s Buyer and Seller Protection are important additional benefits. The Buyer Protection ensures refunds if items are not delivered, arrive damaged, or differ from the description. The Seller Protection, on the other hand, covers merchants against unauthorized payments or claims of non-delivery.

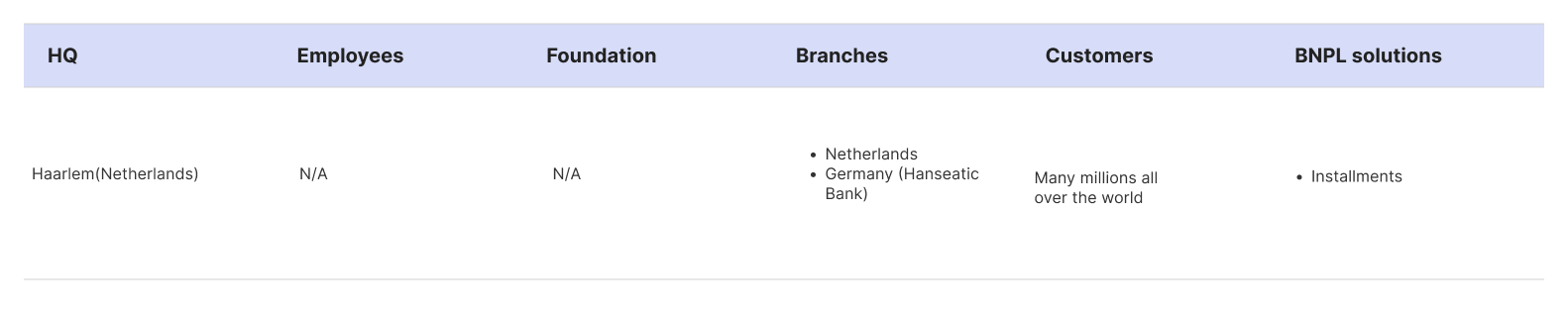

CreditClick

CreditClick is a Dutch payment provider that has been active on the German market since 2021. In cooperation with Hanseatic Bank Hamburg, the payment provider offers installment payments for German e-commerce.

Facts and Figures

Sources:

https://www.creditclick.com/de/

https://www.creditclick.com/nl/

CreditClick’s BNPL solutions

CreditClick only offers installment payments and explicitly labels them as consumer credit on its website. The company promotes tailored credit options, customer-friendly processes, quick application checks within minutes, and the ability to repay early. Shoppers can apply for credit during the checkout in just a few steps. Existing CreditClick users only need their username, password, and a second authentication factor to apply for credit.

CreditClick is available to merchants and payment service providers in the Netherlands and Germany, and installments are repaid via direct debit. In Germany, Hanseatic Bank is responsible for the financing process, from approval to settlement.

What makes CreditClick different?

The technical integration works exclusively via Payment Service Providers (PSPs). That means merchants wishing to use CreditClick must partner with a PSP that includes the provider in its portfolio.

On top, CreditClick emphasizes high security standards, supported by a robust RESTful API that ensures a secure gateway to the e-commerce ecosystem.

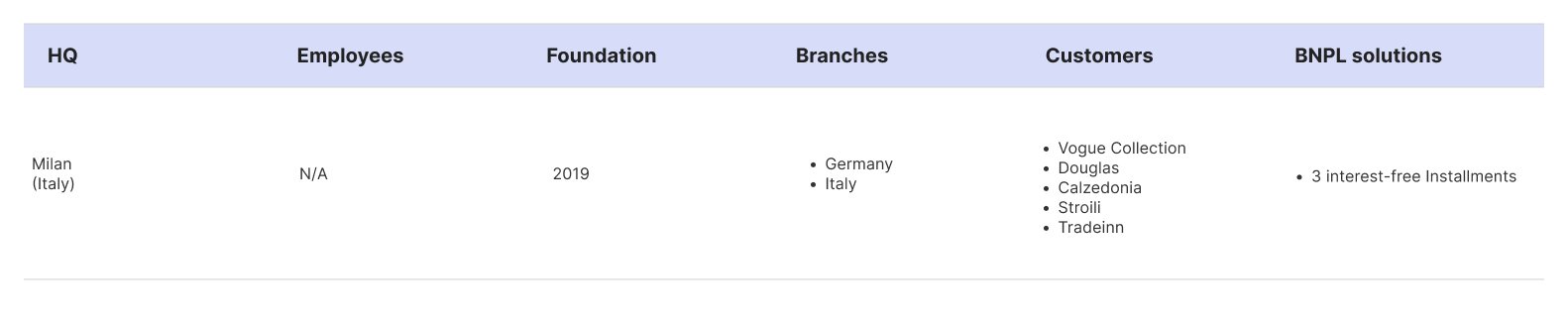

Scalapay

Scalapay S.R.L. was founded in 2019 in Milan, Italy, and has been working on its European market entry since 2021. To support this, Scalapay partnered with Raisin Bank AG, a Frankfurt-based credit institution founded in 1973 that specializes in implementing banking license-required business models for FinTechs.

Facts and Figures

Sources:

https://www.scalapay.com/de/impressum

https://www.scalapay.com/it/dati-societari

https://www.scalapay.com/de/verkaufen-mit-scalapay

Scalapay’s BNPL solutions

Scalapay offers one BNPL option: interest-free installment payments in three equal monthly rates. The first installment is due on the day of purchase, the second in the following month, and the third one month later. The company supports purchases up to €1,000.

To use Scalapay, shoppers must create an account and add a payment method – either credit, debit, or prepaid cards. Important to know is that new customers receive a personal spending limit called the Scalapay Purchase Power. It’s calculated based on factors such as the shop they are shopping at, the banking card, and any previous order history.

Initially, this limit may be lower for new users, but it increases over time with positive payment behavior. And the maximum limit doesn‘t depend on card balance or coverage. Essential to note: Customers using prepaid or debit cards may have a lower Purchase Power.

What makes Scalapay different?

Scalapay’s BNPL solution is available for both online and in-store purchases, making it attractive for merchants with a physical point of sale.

It includes reminder notifications for upcoming installments and a clear overview of all orders and payments. Moreover, Scalapay offers shoppers payment flexibility: installments can be easily postponed or paid early.

Riverty (formerly AfterPay)

Riverty GmbH has been the new brand name of Avarto Financial Solutions since 2022. Avarto, part of Bertelsmann, was originally founded in 1961. Former sub-brands such as Paigo, Afterpay, and Aqount are consolidated under the new name.

Important: Don’t confuse the German provider Riverty with the Australian payment company of the same name.

Facts and Figures

Sources:

https://www.riverty.com/de/business/unternehmen/ueber-uns/

https://www.riverty.com/de/business/produkte/buy-now-pay-later/

https://www.bundesanzeiger.de/pub/de/start?0

Riverty’s BNPL solutions

Riverty offers invoice payment, different installment plans, and the consolidated invoice payment.

Payment by invoice: Shoppers can pick a payment term between 14 and 30 days. No account or app is required – just a valid email address to receive the invoice. Payment is made via standard bank transfer. Additionally, Riverty offers the option to extend the payment deadline by 7 days for free or by 21 days for a fee (available only in the Riverty app).

Installments: Riverty provides installment plans of 3, 6, 12, or 24 months. According to the payment provider, merchants can define both the down payment and the monthly installment amounts.

Consolidated invoice payment: Riverty allows shoppers to consolidate multiple purchases into a single monthly invoice. The company issues around 2.5 million of these consolidated invoices each month. This option requires the Riverty app.

What makes Riverty different?

The payment provider complements its BNPL solutions with two apps packed with useful features.

- The Riverty App helps shoppers manage invoice payments. Automated payment processes ensure timely settlement of outstanding amounts. Returns can also be handled directly in the app: shoppers just mark the returned items, and Riverty updates the invoice amount promptly, without waiting for confirmation from the online shop. Another convenient feature: monthly installments due on a specific date can be split into smaller partial payments in advance.

- The Riverty Back in Flow App, on the other hand, is designed for consumers who want better control over their finances. It connects directly to the user’s bank account to analyze income and expenses, provide balance forecasts, highlight savings opportunities, and track progress toward financial goals.

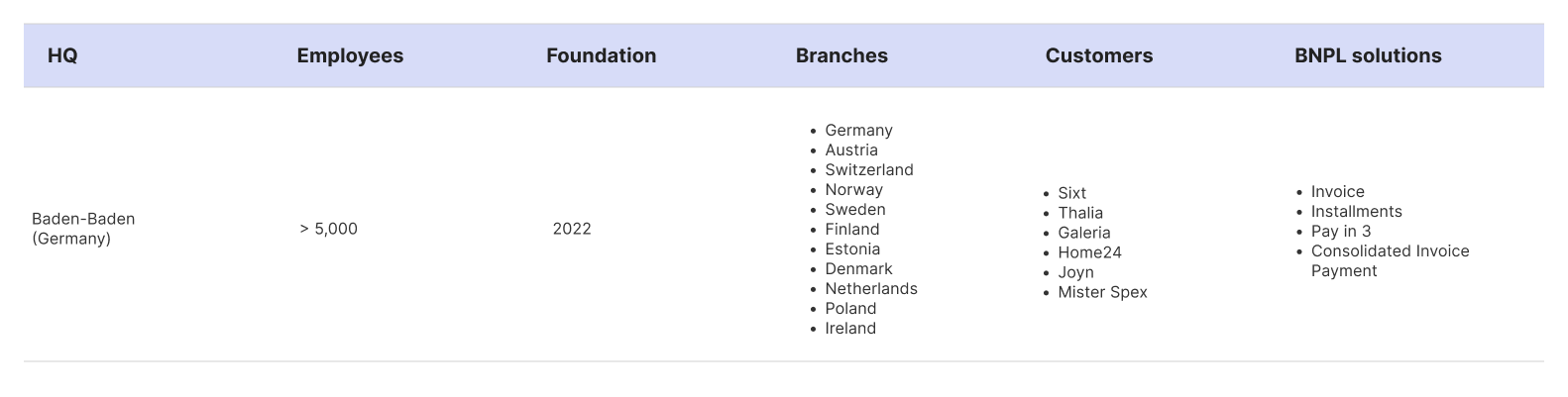

Payla

The Payla Services GmbH doesn’t target merchants directly. Instead, the company offers its BNPL products to PSPs and financial institutions as BNPL-as-a-Service. Payla’s white label solutions can be used both online and at the point of sale.

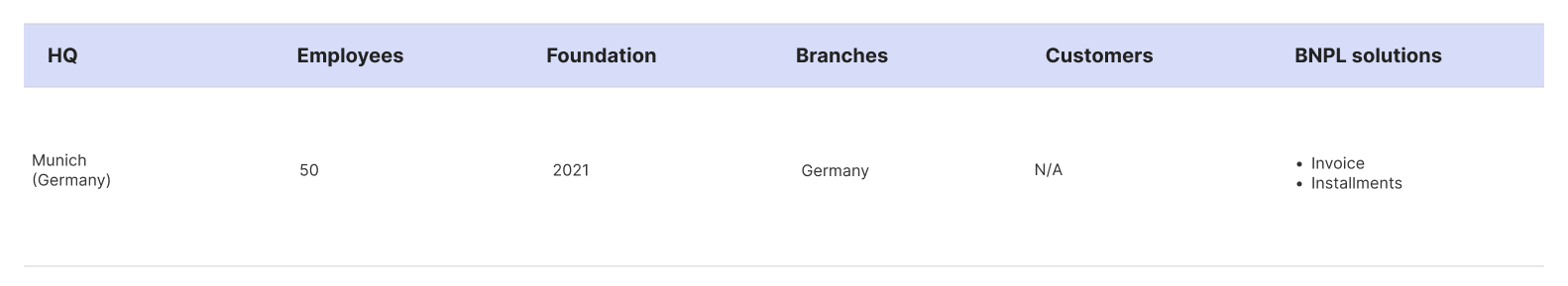

Facts and Figures

Sources:

https://www.payone.com/DE-de/ueber-uns/presse/strategische-partnerschaft

https://thepaypers.com/company/payla-services-gmbh/333

https://www.unternehmen24.info/Firmeninformationen/Deutschland/Firma/5030134

Payla’s BNPL solutions

Payla offers two BNPL options: payment by invoice and installments. Specific details on payment terms or fees are not provided on their website. However, the company positions itself as a full-service provider, handling technical processing, risk management, accounts receivable management, customer support for merchants and consumers, and refinancing of receivables

What makes Payla different?

Payla provides a white label solution: when a PSP integrates Payla’s BNPL solutions into an online shop’s checkout, neither merchants nor shoppers notice the payment provider in the background.

Summary

Germany offers a solid selection of BNPL providers, each with different products and services targeting diverse e-commerce segments. Which solution is best for your shop depends on your individual needs. There is, however, one important point to keep in mind:

Most providers offer additional services that are only accessible via an app and a personal account. And shoppers who decide to register benefit from these extra features and offers.

The flip side: BNPL providers build their own customer relationships with your shoppers. In the case of installment plans, these relationships can last up to three years. During this time, customers may be exposed to several marketing campaigns from the BNPL provider, such as promotions for their own financial products or recommendations for other online shops. Some even operate their own shopping or price comparison platforms, potentially featuring competitor products at better prices.

This can put the loyalty between you and your customers at risk.

In a nutshell: For merchants focused on owning the customer relationship, opting for a customizable white label provider like Ratepay ensures the brand experience remains consistent. This way, no external provider stands between you and the customer.

Customize your checkout for free

Try our Checkout Simulator to instantly experience how the Ratepay payment solutions would appear in your checkout.