Payment solutionsMay 31, 2023

SEPA: Bank transfer, direct debit, and card payment

This is how SEPA payment methods work.

Content & Communications Team

On February 1, 2014, national cashless payment methods (bank transfers and direct debits) were standardized across Europe with the introduction of SEPA (short for: Single Euro Payments Area). Today, no less than 36 European countries participate in the SEPA system, including all EU member states as well as non-EU countries such as the United Kingdom, Monaco, and Switzerland.

The goal of establishing a unified payments area was straightforward: to make cross-border payments within Europe easier, faster, and more consistent. After all, as European economies continued to grow more interconnected, so did the need for a harmonized payment system that could operate seamlessly across borders. And with SEPA, international transfers and direct debits can be processed just like domestic payments.

In this article, we’ll explore how the SEPA payment methods work, the benefits they offer, and where the European payment system is headed next.

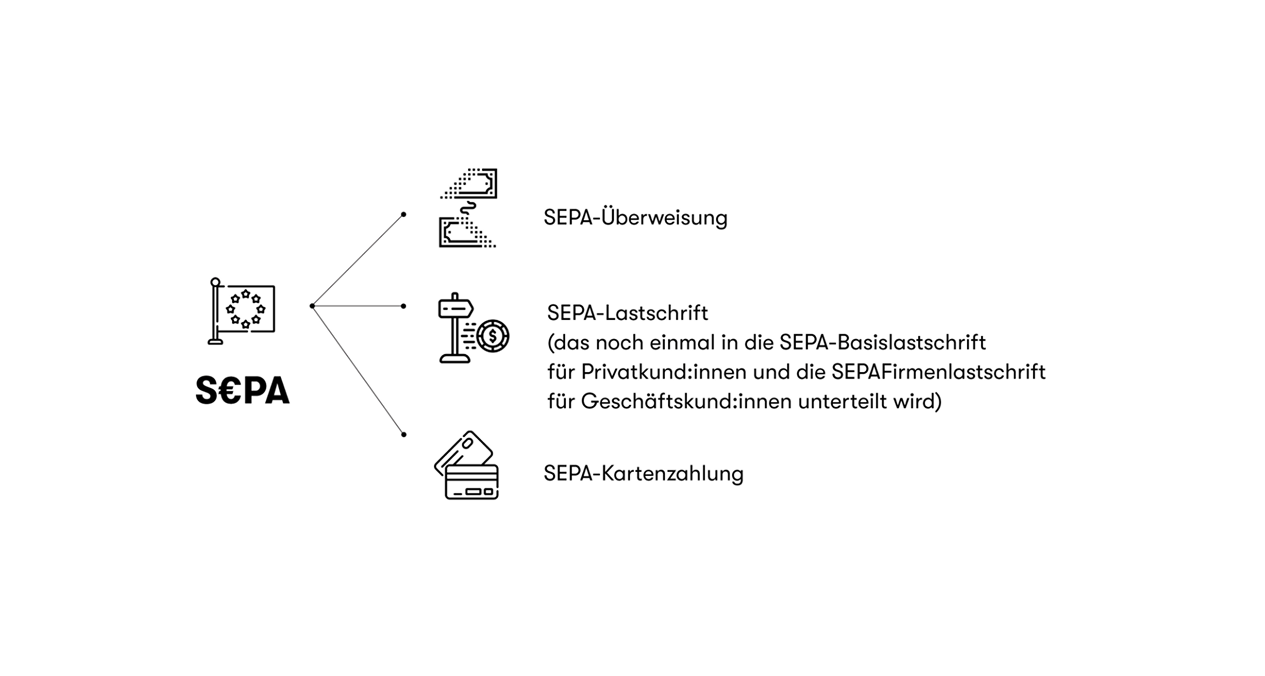

The 3 SEPA payment methods

SEPA essentially offers three types of payment methods. Let’s take a closer look at how each SEPA payment type works.

SEPA credit transfer

SEPA credit transfers did not change the cost structure for domestic transfers within Germany. However, cross-border payments within Europe became much simpler and significantly cheaper.

A SEPA transfer is free of charge as long as:

- The sender and the recipient both hold euro accounts

- The transfer is executed in euros.

Important: Banks may charge additional fees for transfers over €50,000. Transfers of €12,500 or more to other countries must also be reported to the German Bundesbank for statistical purposes. The only exception are private individuals transferring money from their own account to another personal account within the EU.

Banks may also charge fees when transfer details are incorrect or incomplete, as these create additional administrative work.

This could also be interesting: 5 reasons to offer SEPA Direct Debit in your checkout

Processing times and legal deadlines:

Processing times for SEPA transfers are legally defined in § 675s BGB:

- Domestic electronic transfers: must reach the recipient’s bank no later than the next business day.

- Paper-based transfers: must arrive latest by the second business day.

These rules apply equally to cross-border transfers within the SEPA area. And they are always executed in euros, even when the recipient account is in a non-EU SEPA country such as Switzerland.

IBAN and BIC:

Before SEPA’s launch in 2014, Europe already had a standardized bank account identification: IBAN (International Bank Account Number) and BIC (Bank Identifier Code). These gradually replaced the former national account number and bank code.

SEPA transfers have used IBAN and BIC from day one. And Germany fully phased out the old format by 2016.

Now, IBAN is always required for SEPA transfers. The BIC, on the other hand, is generally no longer needed for most transactions. Exceptions include Monaco, San Marino, and Switzerland.

Liability for incorrect transfers:

Customers are always responsible for entering the correct transfer details. But regardless of who made the mistake (customer or bank), recipients must return funds that were wrongfully transferred.

If the transfer has not yet been executed, the sender can request a cancellation from their bank – but must act quickly, since SEPA transfers are usually processed within hours.

Good to know: Banks often charge fees for cancellations.

SEPA Direct Debit

Unlike SEPA transfers, where shoppers initiate the payment themselves, SEPA direct debit works via a so-called SEPA mandate: the account holder authorizes the creditor to withdraw a due amount at an agreed time.

This can be:

- A one-time payment (e.g., online shopping)

- A recurring payment (subscriptions, utilities, leasing contracts), and may involve fixed or variable amounts.

To collect funds via SEPA direct debit, the creditor must have a Creditor Identifier. That’s a unique code verifying authorization to use the SEPA debit scheme.

Since November 2019, SEPA offers two types of direct debit:

- SEPA Core Direct Debit: for transactions between consumers and businesses.

- SEPA B2B Direct Debit: only for businesses and self-employed professionals.

Learn more about SEPA direct debit at Ratepay.

Refunds:

SEPA direct debits can be reversed within eight weeks, no questions asked. The shopper simply contacts their bank and disputes the debit, without needing to provide a reason.

However, unnecessary or unjustified reversals may lead to chargeback fees, which banks pass on to the payer. A “chargeback due to insufficient funds” also counts as an unjustified reversal and triggers fees as well.

- If a valid mandate exists: 8-week reversal period

- If no valid mandate exists: customers have 13 months to dispute the debit

If a bank refuses a reversal, customers should request it again in writing (certified mail) and cite the relevant regulations. If conflicting rules are given, the bank must provide a justification.

Important: Refunds are not reported to SCHUFA.

Did you know that with Ratepay, you can offer shoppers the option of paying by direct debit and subsequently splitting the costs in installments? Learn more about Direct Debit+.

SEPA card payment

SEPA card payments refer to cashless in-store payments using a debit card. Technically, paying by signature triggers a one-time SEPA direct debit mandate, which is why this system is also known as the Electronic Direct Debit process. These transactions are possible across the entire EU.

In physical retail, consumers typically use their debit card in two ways:

Paying by Signature = SEPA Direct Debit

Signing the receipt authorizes the merchant to withdraw the purchase amount via SEPA direct debit. This process is entirely offline, meaning the merchant takes on a risk of insufficient funds.

Paying by PIN = Processed via giropay

When consumers authorize payment by PIN, the transaction runs through the girocard system. Historically, the most common co-branding partners were:

- Maestro (Mastercard),

- V-PAY (Visa).

However, Mastercard discontinued Maestro on July 1, 2023 and banks that previously issued Maestro cards may now switch to cards labeled “Debit” – which only support direct account payments within Germany. Other banks are already working on alternative solutions.

SEPA goes instant: The future of SEPA

One of the most significant developments in the SEPA ecosystem in recent years is SEPA Instant Credit Transfer, better known as SCT Inst. This payment method enables real-time transfers of up to €100,000, available 24/7, 365 days a year across Europe.

Although SEPA Instant Payments have been available since November 2017, banks were not required to offer them. As a result, adoption remained limited – both among financial institutions and customers.

That’s now changing: Following an agreement between the European Council and European Parliament in November 2023, all payment service providers offering standard SEPA credit transfers in euros will from now on be legally required to support both sending and receiving SEPA Instant Payments.

Additionally, SCT Inst offers a key advantage: fast and secure cross-border payments across the entire SEPA region. This capability – previously unique to giropay via its co-badging approach – was designed to support seamless cashless payments throughout Europe.

It remains to be seen how SEPA will evolve. But one thing is certain: the transformation of European payments is well underway.

Discover the power of SEPA for your business!

Book a free demo and speak with one of our experts.