Product releaseJanuary 9, 2026

E-wallets vs. Buyer Portal: The hidden risks for customer loyalty

Data protection, neutrality, and full customer loyalty for merchants. Find out why our new Buyer Portal is not just another e-wallet.

Clara Porath

Content & Communications Manager

E-wallets promise convenience. But at what cost?

Behind the smooth checkout experience, many e-wallets compromise what matters most: your customer relationships.

The Ratepay Buyer Portal takes a different approach – one that keeps your brand front and center. Find out why in this article.

By the way: this article is part of our new Buyer Portal series. Read part 1 here.

Personal data should never be a business model

As a white-label payment solutions provider, our goal is to reinforce the bond between you and your customers. How? By staying in the background and not interfering with customer loyalty.

No matter where your customers are in the buying process, we act as the enabler behind the scenes. Although we perform credit checks, initiate transactions, handle customer service related to payments, and much more, we always remain invisible.

The result: your customers stay immersed in your brand experience and perceive every step of the journey as a direct interaction with your shop.

This is a benefit we are extremely proud of: a solution that strengthens your brand without compromise.

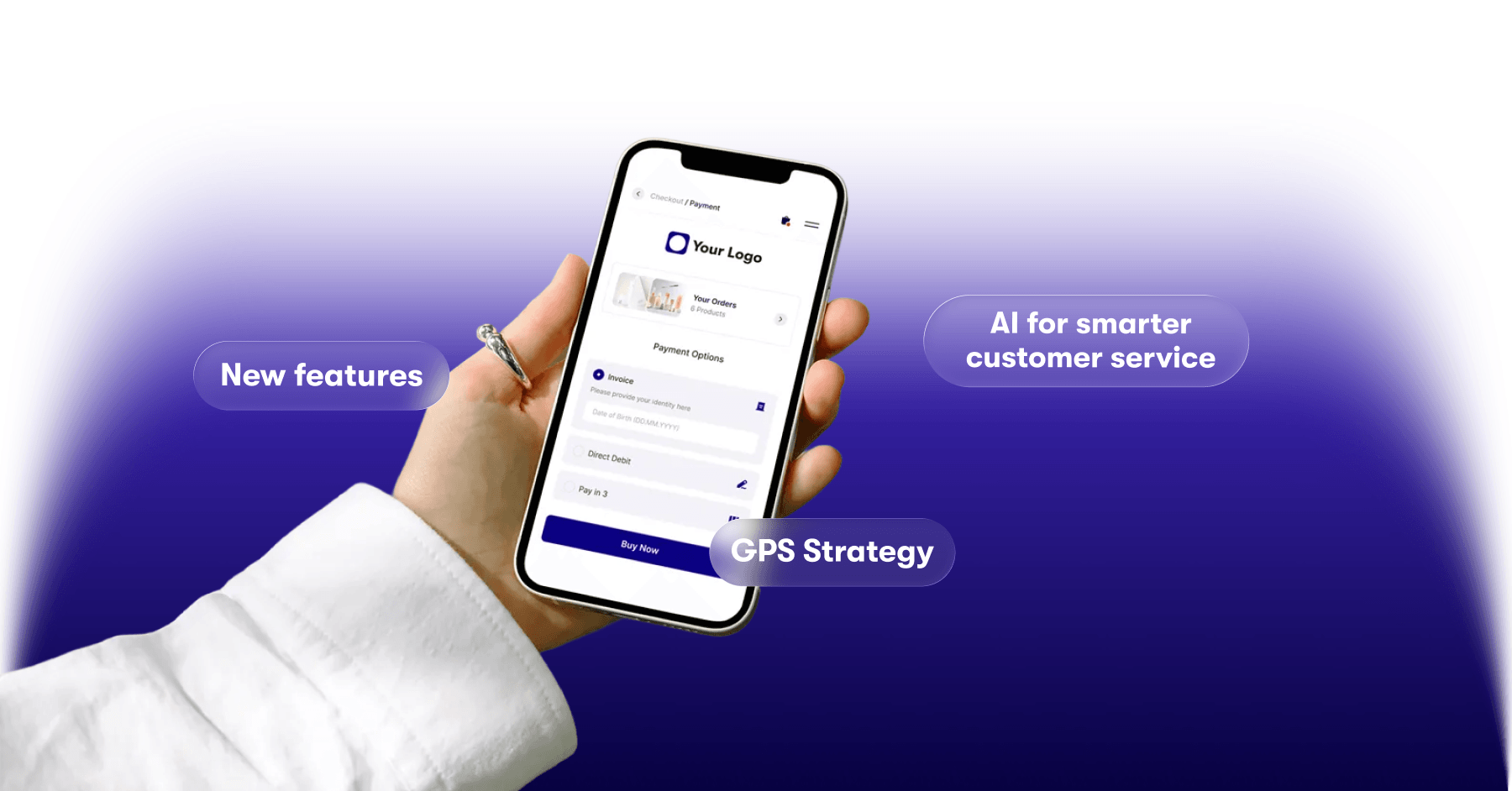

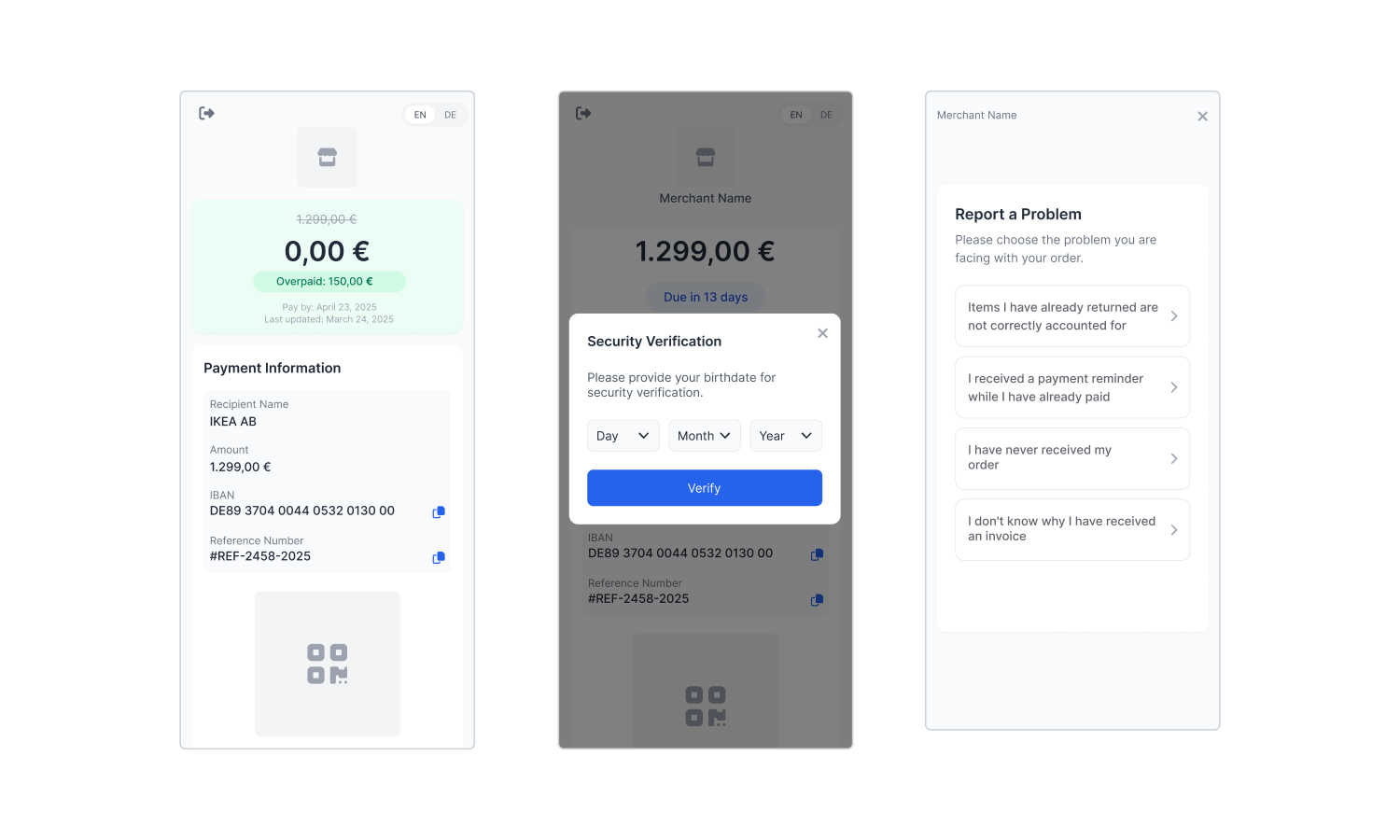

Customize your own experience

Customize your checkout and instantly preview a branded experience.

And the reason our Buyer Portal is not an e-wallet. After all, e-wallets pursue a fundamentally different business model: they utilize personal data, order histories, and buyer profiles for their own benefit.

In short, they use your customers' data for their lead generation.

The Buyer Portal: No lead generation, no hidden agendas

The Buyer Portal only stores the data that your customers actually need for payment, returns, or service inquiries. And merely the data relevant to the order in question.

No additional personal information is required or stored. Not even login details are needed for registration and sign-in. This makes our Buyer Portal particularly secure in terms of data protection and potential fraud.

Above all, we give you, the retailer, a clear guarantee:

- We do not collect personal data for our own lead generation purposes,

- and use the minimal amount of customer data required for payment exclusively for order processing.

Or, as Martin Kuffel, our Head of Reseller, puts it:

Why e-wallets put your brand at risk

E-wallets often utilize your customers' data for their own purposes. This can have a significant impact on your business model as an online merchant.

1. Upselling and cross-selling: How e-wallets promote competitors

The personalized advertising that e-wallet providers display based on user profiles can have a significant impact on the success of your e-commerce business.

Suppose you run an online store for electronic goods and some shoppers have purchased a gaming console from you. A traditional e-wallet provider might conclude that these customers:

- Have a general interest in products in the same price range and category.

- Are interested in related categories.

Why? Because people who use game consoles are usually also interested in gaming accessories, such as gaming PCs, new games, or headsets.

Consequently, the e-wallet provider targets this audience with ads for other electronics stores that (1) offer similar products and (2) also accept e-wallet payments.

The result: shops with a similar product range compete directly with your offering.

With our buyer portal, the situation looks different:

Your customers are not made aware of other online shops. That's because we consider your customers to be your customers. And that doesn't change throughout the entire shopping and payment process. Promise!

The buyer portal serves only the purpose of paying for specific orders in your shop, processing returns, or handling customer service inquiries related to the transaction.

It does not turn your customers into target groups for personalized advertising from your competitors' shops.

2. Financial products: When e-wallets become banks

Quite a few e-wallet providers have, sooner or later, started operating as banks. Thus, they have expanded their portfolio accordingly, offering credit cards, instant access savings accounts, and installment payment options.

And of course, these products and services are heavily advertised – whether directly in the wallet, via newsletter, or push notifications.

Again, this can have an impact on your e-commerce business:

- The e-wallet is used less frequently: not all consumers like being targeted with personalized advertising in an e-wallet. This can lead to reduced usage. Including in your online store.

- Indirect competition: If the e-wallet offers additional financial products, it can lead to competition with other payment methods.

Here's an example:

An e-wallet provider offers Pay in 30 Days at the checkout of an electronics retailer. The shop also offers the option of paying by credit card via another payment provider. At first glance, this does not seem like competition.

But as soon as the e-wallet provider adds credit cards to its portfolio, the situation changes. This is because shoppers who are tied to the e-wallet provider via Pay in 30 Days automatically become the target group for the new credit card offering and may soon start using their credit card instead.

As a result, the e-wallet provider's credit card will compete directly with the credit cards of other providers at checkout.

And that can have numerous consequences: customers could use the e-wallet provider's credit card more often in the future – which would have an impact on the merchant's transaction costs. In addition, the other credit card provider might disapprove of the sudden competition.

This might also be interesting for you: Payment by invoice for online shops: why white label is the best choice

With our buyer portal, the situation looks different:

With the Ratepay Buyer Portal, you avoid this messy situation. That's because we do not sell your customers any other financial products or solutions that could compete with other payment methods in your shop.

Peace of mind for merchants and shoppers

The issues outlined above are eliminated with the Buyer Portal.

After all, a core part of our business model is to never do business with your customers' data. In addition, our solutions do not create competition between different payment providers. Ratepay is and will remain neutral in every respect.

Get to know the Buyer Portal

Discover how the Buyer Portal keeps your brand in control.