InsightsDecember 17, 2025

Ratepay’s 2025 highlights: Our year in review

2025 was a year of growth for Ratepay. Here are our highlights from the past 12 months.

Clara Porath

Content & Communications Manager

This year, the e-commerce landscape was more dynamic than ever, driven by new regulations, shifting business models, and rapidly changing customer expectations. In this challenging environment, Ratepay didn’t just react – we actively helped shape the market.

Let’s take a look back at the biggest highlights that defined our last 12 months: from new feature releases and strategic partnerships to technological advancements.

Our roadmap for 2025: The Ratepay GPS strategy

Developed in 2024, our Ratepay GPS strategy – Grow, Partner, Simplify – remained our golden compass throughout 2025. It helped us set the right priorities, drive meaningful impact, and focus on what matters most to our merchants.

G for grow

“G” stands for growth. As a company, as a payment provider, and as a partner.

In 2025, we emphasized this ambition with strong merchant growth and successful product launches.

Our highlight:

Together with UniCredit Bank, we successfully closed a scalable €125 million securitization transaction, enabling faster payouts and strengthening both liquidity and operational efficiency for our merchants.

P for partner

The “P” stands for partnerships, a central cornerstone of our identity. Our goal: to bring banks, merchants, and PSPs closer together and strengthen the BNPL ecosystem.

This year, we reinforced this approach with both our trusted existing partnerships as well as four new, valuable ones.

Together with our partners Adyen, PayPal, and Computop – now part of the Nexi Group – we we introduced new to expand our reach, strengthen collaboration, and enable merchants to onboard even faster.

We were also excited to welcome Avarda, Green Banana, Lynck, and Vobapay to our partner network.

S for simplify

The “S” reminds us to reduce complexity for partners, merchants, and shoppers. Our ambition: to make it faster, easier, and more convenient to work with us and our solutions.

In 2025, we took major steps forward:

- Our customer service is now supported by three powerful AI agents.

- Five new solutions make our merchants' checkout experiences even more flexible.

These initiatives pave the way for a checkout experience that is seamless, intuitive, and efficient for merchants and shoppers alike.

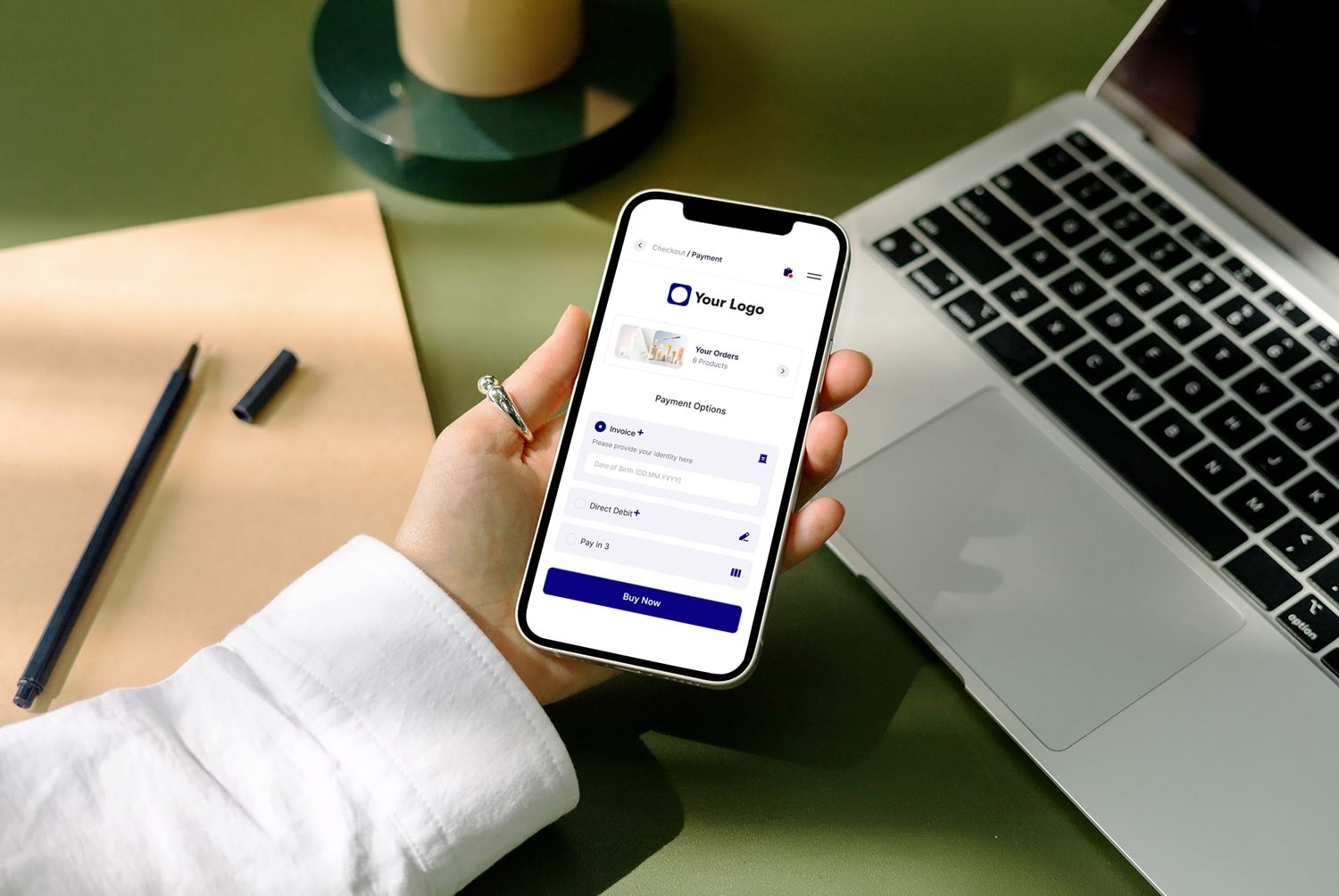

New features

Trusted Ratepay solutions like invoice and direct debit remained essential parts of our offering this year. And for good reason: invoice payment remains the second most popular payment method on the market, with one in four shoppers choosing it at checkout.

Building on this foundation, we continued to evolve our product landscape in 2025 to give our merchants more flexibility, efficiency, and conversion. The result: five new features that make the checkout experience safer, versatile, and even more powerful.

Pay in 3: More choice at checkout

Installments are no longer just a US trend – they’re growing rapidly across Europe. And to give shoppers more control over their finances, we launched Pay in 3, allowing them to split costs into three interest-free installments.

Who benefits and how:

- Merchants benefit from stable cash flow, due to upfront settlements and a seamless checkout experience.

- Shoppers gain more financial flexibility by splitting purchases into three interest-free installments.

Hosted Payment Page: Less integration hassle

Introducing new payment solutions can be complex and resource intensive. That’s why we built our Hosted Payment Page. It provides a Ratepay-hosted checkout, allowing online shops to offer popular BNPL options without complex IT setups or lengthy development cycles.

Who benefits and how:

- Merchants save time and resources thanks to fast integration, without additional operational overhead or heavy integrations.

- Shoppers enjoy a familiar checkout experience that seamlessly matches the store’s look and feel.

Read more about the benefits of a hosted checkout.

Buyer Portal: Smarter invoice management with less effort

With competition rising and customer expectations higher than ever, intuitive self-service solutions have become essential. The Buyer Portal enables shoppers to manage orders, payments, and returns easily without login credentials or sensitive banking information. Plus, our trusted white-label approach remains in place and the Buyer Portal aligns seamlessly with the online store’s look and feel.

Who benefits and how:

- Merchants reduce support efforts and strengthen customer loyalty.

- Shoppers manage orders and payments quickly and securely, without complicated logins.

This could be interesting: Introducing the Buyer Portal

OTP: Additional transaction security for high-risk baskets

As online commerce grows, so do fraud attempts. Our new OTP feature adds a quick SMS-based security check to the checkout process, protecting both merchants and shoppers.

Who benefits and how:

- Merchants increase approval rates, especially for high-risk orders, while reducing fraud risks.

- Shoppers are better protected, without making the checkout unnecessarily complicated.

Ratepay merchants: contact us to learn more about your OTP options.

Harnessing AI for smarter customer service: Meet Fynn & Quinn

No matter what we do, technology remains a key enabler for efficiency, scalability, and better customer experiences. This year we made significant strides in our AI strategy. Three powerful AI agents now support daily customer service operations. And Fynn and Quinn deserve special mention.

Fynn is our automated email agent, handling about a quarter of all incoming customer inquiries; independently and reliably.For our customer service team, this means noticeable relief and a significant boost in productivity. And consumers are also responding positively: they appreciate Fynn's quick and accurate answers.

To ensure that quality keeps pace with volume, we introduced Quinn. She reviews and evaluates Fynn’s responses according to strict criteria. Quinn checks over ten times the volume that was previously possible manually.

But even with all our technological advances, one thing remains essential: personal contact. Whenever shoppers prefer a direct conversation, we’re always here for them.

Note: We’re very selective about which inquiries Fynn handles independently and carry out regular spot checks to ensure high-quality standards.

Stepping into 2026 with energy and vision

In the new year, we will focus on rolling out the new feature set – particularly ‘Pay in 3’ – and harmonizing existing APIs. Regulatory matters such as DORA and CCDII, which we eagerly anticipate, are also key priorities of our 2026 roadmap.

We look forward to a successful year together!

Looking to diversify your payment mix in 2026?

Explore our BNPL solutions in a personalized demo and discuss your needs with our experts.