Product releaseJanuary 20, 2026

Pay in 3: Turn hesitation into sales

What is Pay in 3 and which benefits does the flexible payment method offer online merchants?

Clara Porath

Content & Communications Manager

Picture this: A customer adds a laptop to their shopping cart – and pauses. The price feels steep. The decision? Uncertain.

Pay in 3 removes that friction. It helps you reduce abandoned carts, increase basket size, and gain a competitive edge for your online store.

With the recent launch of Pay in 3, let's look at the benefits short-term installment plans can bring.

Check out our Pay in 3 product page...

...and discover how to grow sales with flexible installments.

Hassle-free installments: removing checkout barriers

A new fridge, clothes, or that dream bike. Installment payments aren’t just a US trend anymore. Shoppers across German-speaking markets are embracing the convenient Buy Now, Pay Later option. In fact, according to the EHI study “Online Payment 2025,” installment-based sales have doubled in the last three years.

Why? Because flexible payment plans create financial leeway. They allow shoppers to buy big-ticket items without months of saving.

This lowers checkout hesitation and increases conversion rates. Especially for high-value items.

What is Pay in 3?

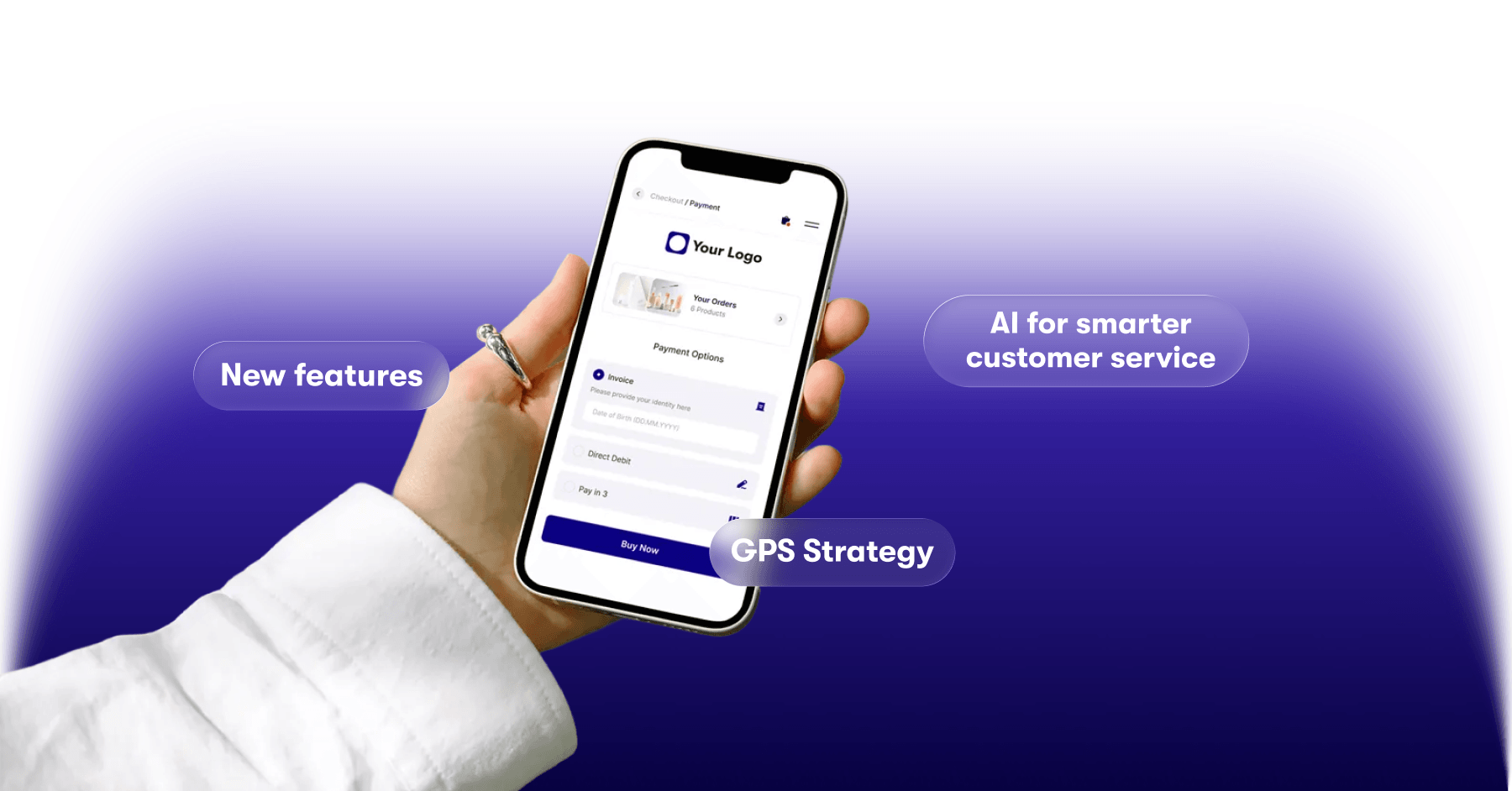

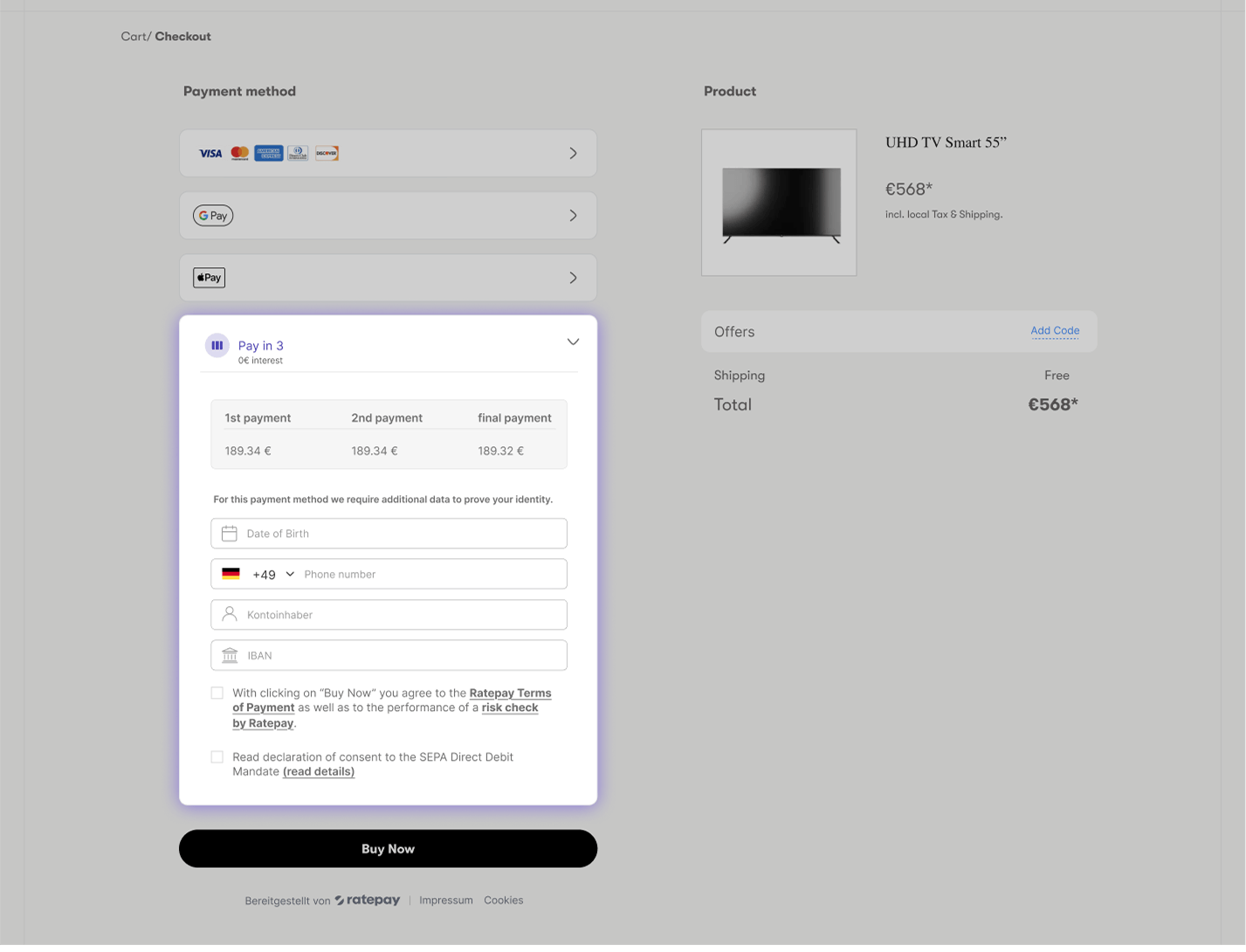

Pay in 3 is a short-term installment solution designed for online merchants who want to offer flexibility – without the economic headaches of long-term financing.

Manageable installments instead of hefty one-time payments

Customers can split the total costs into three equal payments over 90 days. The first payment isn’t due until at least 28 days later.

This means large one-time payments become manageable. And more checkouts successful.

Let's take an example:

A shopper wants to buy a smartphone for €1,200. The price tag triggers hesitation. The customer notices the option to Pay in 3. And instead of paying €1,200 upfront, they pay three installments of €400 – making the purchase manageable and stress-free.

A true game changer for high-value segments like electronics, home & living, and travel.

Bye bye fees

Additionally, Pay in 3 is interest-free and transparent. Shoppers don’t have to worry about hidden charges or surprise service fees.

For merchants, this means fewer abandoned carts and a compelling value proposition for price-conscious consumers.

Further reading: Ratepay’s 2025 highlights: Our year in review

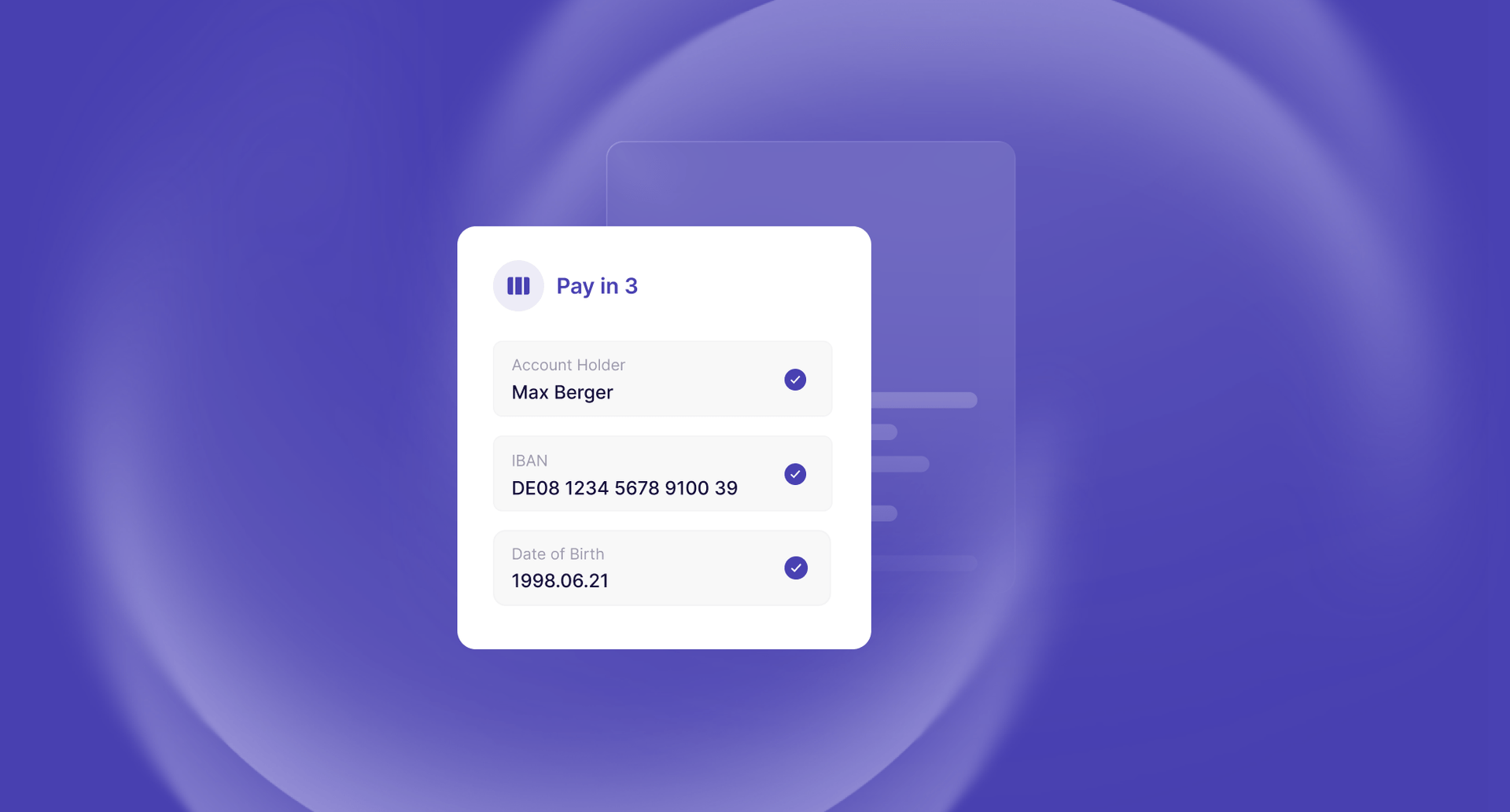

How does Pay in 3 work?

It's pretty simple, for you and your customers:

The 4 biggest benefits for merchants

Here are four reasons why Pay in 3 is great for online shops.

1. Zero risk with payment security

Unsure whether customers will actually pay for the goods?

With Pay in 3, this concern becomes a distant memory. No matter what happens, you will always get paid. Ratepay assumes the entire default risk and handles payment processing.

2. More financial freedom

Splitting costs creates financial freedom. And this offers your customers more flexibility and convenience.

Not only does this boost basket size and conversion rate, but it also leads to happier customers. And as we all know: A satisfied customer is the best business strategy of all.

3. Interest-free and transparent

Unlike traditional consumer credit, Pay in 3 offers convenient zero-percent financing. This encourages high-value purchases and reduces checkout hesitation.

4. Brand-first customization

The customized payment solution delivers a modern, customer-friendly BNPL experience. Your brand stays front and center, building trust and loyalty.

This could be interesting: Ratepay Checkout Simulator

Ready to convert hesitation into sales?

Pay in 3 is available for merchants and shoppers in Germany – fully compatible with popular direct debit options.

If you're excited about Pay in 3’s possibilities, you can book a free demo or contact your Ratepay Merchant Success Manager.

Book your Pay in 3 demo today

Learn more about your opportunities with Pay in 3.