Payment processing in the age of platforms

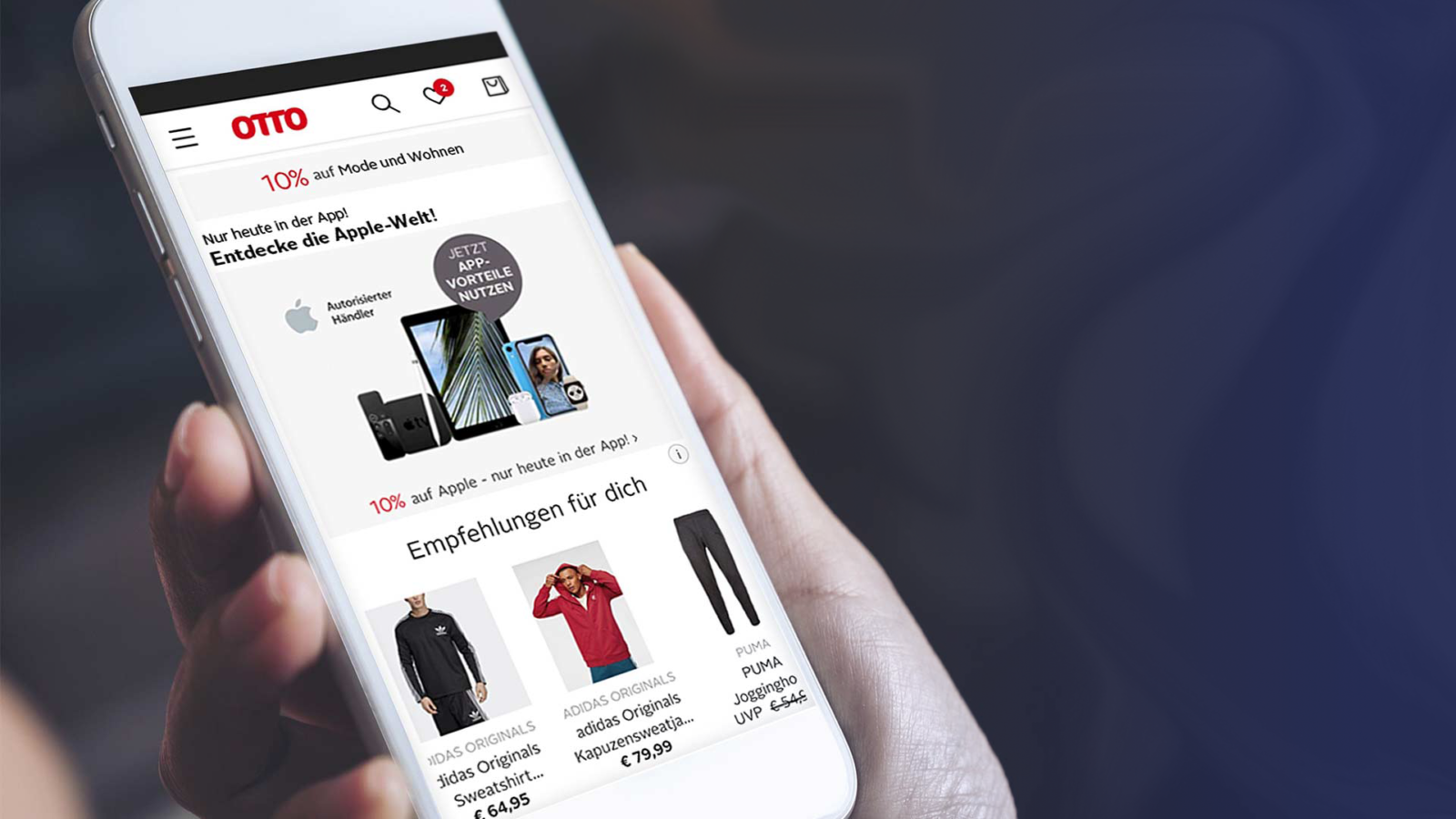

The big success stories in e-commerce are currently being written by online marketplaces that are open to third-party providers. However, setting one up is complex. A uniform payment system is an important building block for the seamless processing of transactions.

We live in the age of platforms. Respected market observers such as management professor Phil Simon and management consultant Alex Moazed have long proclaimed this. Companies like Amazon, Google and Co. would form quasi-monopolies thanks to their marketplace structure, they observe. Competitors, politicians and more or less enlightened consumers have long since taken up this argument and are using it against the giants of the digital economy. Just recently, EU Competition Commissioner Margrethe Vestager accused Amazon of disadvantaging third-party retailers on its platform by using their business data for its own purposes.

However, amid all this criticism – some of which is justified – the advantages of the platform economy sometimes get lost from view. Not least among these is its remarkable resistance to crises. The Corona crisis made this clearer than ever before: the Platform 15 stock index, which bundles the world’s most important platform companies, performed very positively in 2020, while other indices recorded major declines. Even after share prices recovered in the second half of the year, they did not close the gap with the Platform Index.

Platform-as-a-Service

The reason? “Platforms don’t own the means of production, they create the means of connection,” write Alex Mozaed and Nicholas L. Johnson in their book Modern Monopolies. As a result, supply and demand shocks don’t hit them as hard as companies with traditional models, as long as they can continue to make connections and get paid for it.

The advantage for customers is obvious: they want to buy the best product at the lowest price as conveniently as possible. This is precisely why storefronts in city centers used to boom, and then later shopping malls. There was a large selection there that customers could quickly compare with each other. If you needed a new pair of shoes, you could often find three suitable stores within a few hundred meters of each other. The platforms have carried this principle over into the 21st century.

For merchants, a platform is also something positive in principle, despite all the lawsuits and disputes under competition law. For them, the platform is basically a service that they book. For a certain fee, they get access to more customers, a large logistics network and a diverse payment system.

The central role of payment processing

One factor is crucial to the success of an online marketplace: the satisfaction of the players involved – merchants and consumers. The way the marketplace handles its payment transactions plays a major role in this.

Stay up to date with the payment world

Sign up to our monthly newsletter

Customers have similar expectations to merchants: they want it to make no difference to them in the store whether they buy products from external merchants or from the platform operator itself. If possible, this should not play a role in the store itself and certainly not when paying. Statistics show that customers are less likely to order their shopping cart in the end if they are faced with different payment processes for external and internal products. However, if the customer pays for everything in a bundle at the end and can also choose his preferred payment method, this conversion rate increases significantly.

Merchants also want everything from a single source

Since marketplaces do not produce their own products, the user experience of marketplace participants is even more crucial than with non-platform offerings. Merchants and buyers significantly shape each other’s user experience. Successful marketplaces especially understand how to best support the players in their actions with smooth processes.