Contents

[spacer height=”-20px”]

- Myth #1 BNPL equals instalments

- Myth #2 BNPL usage leads to debts

- Myth #3 BNPL providers profit from late fees

- Myth #4 BNPL means downloading another app

- Myth #5 BNPL is just a nice-to-have for merchants

- Myth #6 BNPL is just for gen-Z shoppers

- Myth #7 BNPL is mainly used to purchase electronics

- Myth #8 BNPL means uncontrolled credit card debt

- Conclusions

[spacer height=”-30px”]

Buy Now, Pay later (BNPL) has been around for quite a while. Applauded by both consumers and merchants at the very beginning, this range of payment products have sometimes been met with mixed feelings over time while becoming gradually more popular.

Welcomed by some and lambasted by others, BNPL definitely represents a polarizing topic especially in light of specific events and companies that made headlines over the past decade and were in the spotlight due to malpractices or financial issues.

This led BNPL to encounter some resistance while also attracting the attention of consumer associations and regulatory authorities willing to shed light on deferred payments and the operations of BNPL providers, which, in turn, led to even more negative associations in people’s mind.

But what is perception and what is reality?

Let’s try to analyze some common misconceptions about BNPL to create a more complete picture of what BNPL is or isn’t.

Myth #1 BNPL equals instalments

When people think of Buy Now, Pay Later, they tend to immediately connect this set of payment solutions to instalments. Basically, it is common to think that, for buyers, BNPL means splitting payments to be able to afford expensive goods they wouldn’t otherwise be able to purchase.

Even though financing is one of the use cases for BNPL, when it comes to deferred payments, BNPL providers offer multiple products, and instalments is just one of them.

BNPL, generally speaking, is a range of payment options that allow buyers to flexibly delay or schedule payments, and instalments are usually offered alongside with other products such as payment via open invoice and direct debit, among others.

What specific BNPL product is most commonly used varies from country to country. For example, in the D-A-CH region (German speaking countries,) open invoice (purchase on account) is the go-to method of deferred payment. In this case, buyers place an order, receive their goods, and settle their invoice on the due date.

If we analyze aggregate data of Ratepay’s customers (large e-tailers in the D-A-CH region) we can see that the majority of BNPL transactions occur as open invoice payments (paid out by buyers after 7, 14, or 30 days depending on the merchant’s requirements.) Instalments only represent 3 to 5% of the BNPL transactions.

Invoice is the most sought-after payment method for other BNPL providers as well. Depending on the subvertical, open invoice is the payment method chosen by 30-40% of buyers over any other option (credit card, e-wallet, bank transfer, and so on.)

There are several reasons why people in Germany, Austria, or Switzerland prefer paying via invoice. On the one hand, this is connected to security and privacy (not sharing personal data such as your credit card number with a third-party payment provider,) on the other hand, buyers prefer to first check the quality of the products they order to make sure everything is as described before deciding to pay for or return the items they purchased (a process known as “try-before-buy.”)

Additionally, first time buyers want to make sure that a merchant is reputable without incurring the risk of not being delivered their orders or having issues with returns and reimbursement processes. Only a small portion of buyers in Germany mentioned that they use BNPL to have access to financing options.

Source: EcommerceDB and Statista

Myth #2 BNPL usage leads to debts

This point is tightly interwoven with the previous concept since, as we just saw, most of the BNPL transactions -at least in German-speaking countries- don’t involve any form of financing.

On top of that, it is worth mentioning that different BNPL providers go about risk management in different ways based on their specific business model.

There certainly are companies out there that are more prone to provide access to BNPL service- buyers who raise a few red flags when it comes to either fraud or credit risk. Usually, such companies have different fallback solutions like additional revenue streams, generous VC funds, a large amount of equity, or simply piggyback on credit cards to obviate risks.

However, even though the default rate on BNPL payments is extremely low, not all providers can withstand a high exposure to potentially unsuccessful transactions while underwriting risk, especially when required to remain profitable.

Additionally, European BNPL providers also need to comply with strict constraints imposed by regulatory authorities when it comes to risk and losses.

This means that BNPL companies like Ratepay adopt a very cautious approach to transactions reinforced through both technology (e.g., through specific AI-powered systems that manage fraud detection and risk assessment processes) and information (for instance, internal benchmark data or external databases.)

Such providers operate very responsibly to make sure that the vast majority of transactions occur successfully, and their reputability has a positive impact on the brand of the merchants that implement them.

Myth #3 BNPL providers profit from late fees

As mentioned, the vast majority of BNPL transactions are successful. Nonetheless, there is a very small proportion of deferred transactions that require the intervention of customer service: this occurs when a buyer is late with a payment.

In this case, the process varies from provider to provider. In general, buyers are sent automatic reminders, and the system manages all the steps until a buyer receives a final notice.

Under some specific circumstances, it might happen that a buyer is forced to pay some late fees or dunning charges. However, despite common misconceptions, these fees are meant to cover customer service and debt collection costs. Such charges do not represent and cannot represent a form of revenue for BNPL providers.

Especially for fintech companies based in the EU (and Germany even more specifically,) regulatory authorities impose strict regulations when it comes to BNPL operations, especially when it comes to revenue streams, AML processes, and losses.

For a reputable BNPL provider like Ratepay, for example, the only revenue streams derive from a percentage cut on successful transactions. Profit, therefore, is strictly connected to the merchant’s success (high volume of transactions) and the ability of buyers to pay on the due date.

That’s why the company is extremely cautious when it comes to accepting transactions and, as we briefly mentioned, it leverages the latest AI and ML technology, on top of access to internal cross-platform benchmark data and external validation processes to eliminate the risk of false positives or false negatives and find the perfect balance between acceptance rate (more volume for the merchant) and risk.

Additionally, buyers who struggle to meet their payment deadlines are approached by real people who work in customer service and who, together with the buyer, try to find a reasonable and flexible solution to avoid additional problems within the dunning and debt collection cycle.

Myth #4 BNPL means downloading an app and being bombarded with promotional messages

BNPL comes in many colors and flavors. BNPL products can be offered, among others, by direct providers, banks, credit card companies, Payment Service Providers (PSPs) or are integrated within m-commerce or super apps that also provide customers with other services like comparison portals, recommendations, discounts, shopping guides, and more.

In some cases, BNPL providers rely on multiple revenue streams such as transaction fees and referral fees they generate via recommendation marketing and require customers to register and download an application to proceed.

In this case, it’s true: say you decide to buy some new sandals at “FancyShoes Inc.” using such an app, you can be certain that just a few hours later you’ll be receiving promotional push notifications and/or email vouchers for “EveningPumps Ltd.” Such BNPL providers profit from the fact that you use their service at multiple stores and even earn a commission through their referral.

But this is not always the case. White Label BNPL solutions (like Ratepay) never show their brand and don’t interact with buyers at any point during the payment cycle.

Ratepay: Customer journey – Payment via invoice

This means that the whole checkout experience occurs organically within the merchant’s interface without buyers being forced to abandon the storefront to download an app or sign up for yet another third-party provider.

And this also means that the White Label provider will then just act on behalf of the merchant when it comes to communications concerning payments. At no point in time, the BNPL company addresses buyers in its own name promoting and upselling its own financial services or cross-promoting other products based on the initial purchase.

White Label BNPL providers offer a smooth and seamless buying experience without diluting the merchant’s brand and without taking away business from them. And buyers don’t need to share additional personal data with a third-party provider that leverages such information to generate profit.

Myth #5 BNPL is just a nice-to-have for merchants

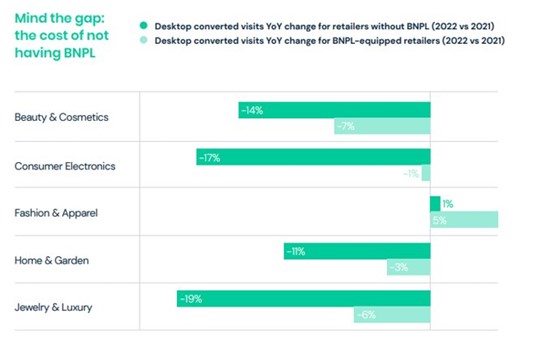

According to a recent e-commerce study carried out by Similarweb, e-tailers that don’t offer BNPL options to their customers experience a lower conversion rate on their platforms.

The cost of not implementing Buy Now, Pay Later is the number of lost opportunities and cart abandonments that impact conversion rate. More specifically, Merchants who offer BNPL are reported to have experienced a 2% year-over-year increase in online conversions compared to companies that don’t offer BNPL and experienced a 11% y-o-y decrease in conversions on average.

The conversion gap varies from sector to sector with consumer electronics presenting the highest return on investment for financing offers followed by jewelry, beauty & cosmetics, and home & garden.

Source: Similarweb’s “The state of e-commerce 2023”

The lack of flexible payment options is a key driver of cart abandonment. Almost 27% of buyers of products within the category of consumer electronics mentioned that they wouldn’t have bought such products without access to BNPL options.

And now more than ever, considering the current adverse conditions in e-commerce driven by economic uncertainty and sociocultural changes, it is extremely important to be able to convert as much traffic as possible into paying customers while maximizing CLTV.

And a higher CLTV is exactly what BNPL solutions offer through a higher conversion rate, lower cart abandonment, higher AOV, and more repeat purchases.

BNPL (especially when white-labeled) allows merchants to convert more customers and do more business with them.

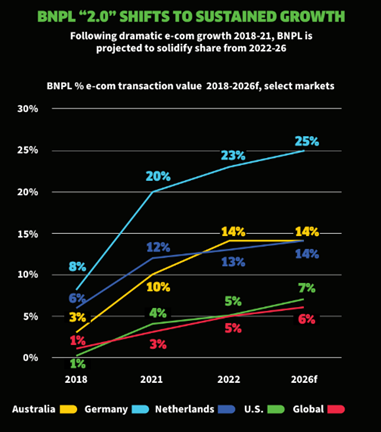

Even if the portion of buyers who preferred deferred payments varies from country to country, BNPL is projected to grow over the next years, and it’s essential for merchants to offer a relevant payment mix at checkout to maximize conversions.

Source: FIS – „Global Payments Report 2023″

Myth #6 BNPL is just for gen-Z shoppers

50% of people in Germany have paid at some point using a BNPL product. And even if it’s true that younger people tend to be attracted by financing options, over 25% of over 45-year-olds regularly uses BNPL in Europe.

Source: E-Commerce DB and Statista

This is particularly true in Germany, thanks to the popularity of open invoice as a payment method.

It is worth noting that the percentage of millennials, gen-Xers, and boomers using BNPL increases sharply when it comes to White Label BNPL.

The reason why is connected to simplicity. While branded BNPL providers force generally tech-savvy users to access an external portal or app and register for yet another third-party service, white labeled BNPL products only require buyers to enter their date of birth directly at checkout and proceed with their purchase without interruptions or additional steps.

Another important factor is that young people are more familiar with branded solutions while older generations tend to distrust unknown brands and prefer to only provide information to the merchant they know and trust. And white label products are directly embedded within the checkout interface without any branding allowing buyers to process their payments directly with the merchant.

Ratepay’s customers in sectors like pharmaceutical products (generally addressing an older audience) witnessed a dramatic increase In conversions after adding Ratepay’s unbranded BNPL products at checkout and some of them even decided to eliminate their branded BNPL provider.

Myth #7 BNPL is mainly used to purchase electronics

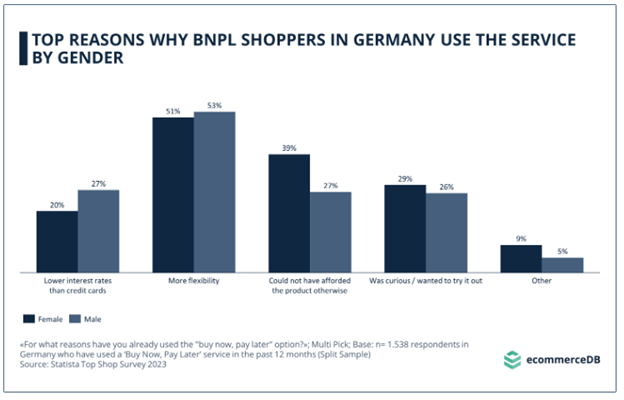

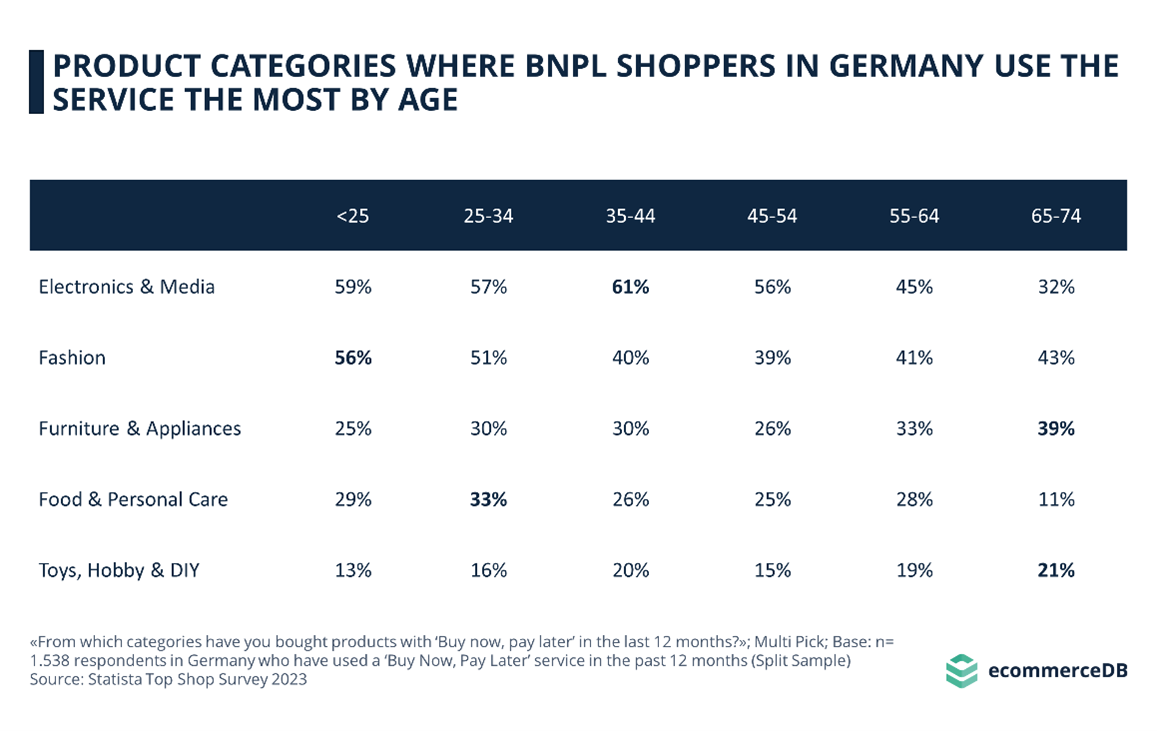

Depending on the geographic region, Buy Now, Pay later is a popular payment option for different product categories. The distribution is also connected to age groups.

72% of 25-24-year-olds used BNPL for fashion purchases in 2022 according to Similarweb. Sportswear purchases are also often connected with BNPL, and younger generations tend to lead the pack in this segment too.

But fashion buyers in general seem to appreciate the flexibility of BNPL. Over 35% of 35–44-year-olds purchased fashion & apparel products through BNPL last year.

The try-before-buy effect is definitely a key driver of BNPL transactions in fashion, but millennials and gen-Xers also utilize BNPL for other product categories. 48% of 25–35-year-olds purchased home appliances using open invoice, direct debit, or installments over the past 12 months.

Source: https://ecommercedb.com/insights/chart/10596

Gen-Z shoppers are ahead when it comes to gaming consoles (62% of them made purchases in this category using BNPL) and younger generations certainly contribute to the connection between consumer electronics and BNPL, but this set of payment options is now ubiquitous and every product category can profit from more conversions driven by at least one of the BNPL payment options, based on their target group.

Myth #8 BNPL means uncontrolled credit card debt

As mentioned before, there are numerous different business models when it comes to BNPL. Apart from credit card companies offering their own solutions for deferred payments, some direct BNPL providers provide buyers with a solution to split payments using their credit card.

Others don’t require customers to have a credit card and allow payments to be settled using other solutions such as bank transfer (especially in Europe) or through other payment applications.

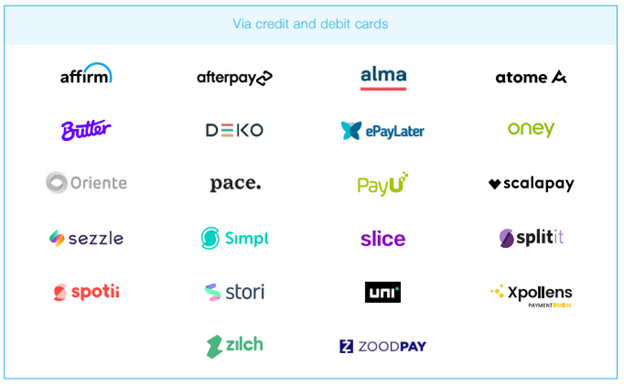

List of providers that offer BNPL via credit or debit card.

Source: The Paypers – „Payment Methods Report 2022“

The advantage is obvious especially in countries where people already need to keep an eye on their credit card debt and prefer to avoid charging their cards through additional transactions.

80% of American consumers, 70% of UK consumers choose BNPL specifically to avoid additional credit card debt according to Experian. And the percentage of German buyers who opt for BNPL for the same reason is approximately 40% as reported by CrefoPay.

Several BNPL solutions are not credit-card-based (like Ratepay, for example) but may offer this form of payment as one of the options buyers can choose when a payment (invoice or instalment) is due.

Conclusions

In summary, a lot of myths revolving around BNPL derive from incomplete information, geographic discrepancies, and segmented data based on different age groups.

Additionally, not all BNPL providers operate using the same business model and processes are different also based on where such providers are headquartered.

Some mental associations and biases hold water just for a small portion of providers in particular regions and/or operating with specific product categories.

One thing is for sure. If you’re interested in maximizing your CLTV by working with a reputable partner with a responsible approach to financial operations and that truly embraces the White Label approach, Ratepay is the BNPL provider that disproves all misconceptions within the scope of its “proud to be different” business model.

Use BNPL for your

e-commerce