Purchase by open invoice with white label: a must for every online shop

Buy now, pay later – BNPL for short – is becoming increasingly popular in online shopping. Not only on a global level. Analyses from German-speaking countries also show: Online shoppers appreciate it very much when the payment term for a purchase is in the future. This is especially the case with payment by open invoice.

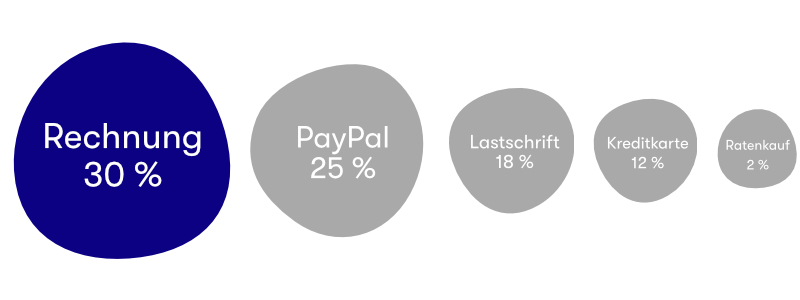

According to the Nets E-Commerce Report 2020, purchase by open invoice ranks first as the most popular payment method in Austria and Switzerland with 30%, ahead of all other common payment solutions. From the perspective of successful conversion, this is reason enough to integrate purchase by open invoice as an option in the checkout of an online shop.

Shares of selected payment methods in the turnover of the German eCommerce market

(Source: EHI Study Online Payment, 2021)

In addition, online shops that offer purchase by open invoice grew by 46% more in 2020 than shops that did not (raw data EHI study Online Payment, Top 500, 2020).

Stay up to date with the payment world

Sign up to our monthly newsletter

The best solution, therefore, is to offer purchase by open invoice but outsource it to a specialised payment partner. This is also supported by the other data of the EHI study Online Payment: online shops with outsourced purchase by open invoice have grown by 25 % more than shops without this option.

Which payment provider is the right one for purchase on account?

When looking for the right payment provider, it is not only cost and turnover considerations that play a role. Above all, on the customer side, the image of the respective payment provider must be analysed: This is because the purchase by open invoice in the checkout is “branded” – i.e. operated under the brand of a third-party provider. This provider appears as an independent payment solution through which the claim is later settled.

Questions arise here such as: Which payment provider is popular and widespread among shoppers, who has the best ratings in social media? In short: Which payment brand do customers trust most when they choose payment on account for online shopping?

White label: the conversion booster

The best payment provider is no payment provider. Or more precisely: a payment provider that you neither see nor notice – called “white label” in the jargon.

According to a study by Bilendi GmbH from January 2021, 31 % of shoppers opted for purchase by open invoice when this payment method is available under the logo of a third-party provider. In contrast, 48 % of shoppers selected purchase by open invoice when it is clickable in the checkout without brand branding, i.e. as a white-label option. The impression that purchase by open invoice is an offer of the online shop thus contributes to a conversion increase of 54 % according to this study.

How white label increases conversion

Left picture: 48 % choose the white-label invoice purchase.

Right picture: 31 % choose invoice purchase via a third-party provider.

Conversion increase: 54 %

(Source: Bilendi Study 2021)

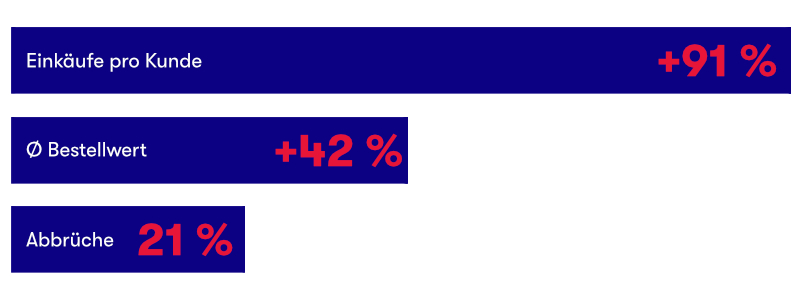

The American market research company Forrester Research also comes to this conclusion. Forrester presented a case study in 2021 that examined a white-label payment solution on a medium-sized e-commerce platform for luxury goods and perfumes with headquarters in Australia and an annual turnover of approximately 12 million US dollars.

The study confirms that the introduction of a white label solution was able to increase the average order value by 42%. At the same time, purchase abandonment was reduced from 30 % to 21 % and the number of purchases per customer almost doubled from 1.26 to 2.31 purchases per year.

(Source: https://australianfintech.com.au)

In the study, merchants also reported stronger customer loyalty and higher returns from in-house post-purchase email campaigns – in contrast to third-party payment providers who send these emails in their own branding.

So all these factors combined contributed to a much higher customer lifetime value.

Conclusion

Anyone who wants to give their e-commerce in the German-speaking world another strong boost should take three things to heart:

- The purchase by open invoice must definitely be available to shoppers as a payment option in the checkout.

- The purchase by open invoice should be handled by a payment expert as a third-party provider in order not to be confronted with the default risk that is typical for this payment method.

- The purchase by open invoice should be integrated into the checkout as a white-label option. In this way, you are not at the mercy of the image development of a payment provider, which shoppers are more or less inclined towards depending on current developments. If no third-party provider interferes with the purchase process with its brand, the trust that shoppers have in the online shop is significantly transferred to the selected payment method.